[et_pb_section fb_built=”1″ _builder_version=”4.8.2″ custom_padding=”||0px|||”][et_pb_row _builder_version=”4.8.2″ width=”100%” module_alignment=”center” custom_padding=”9px|11px||11px|false|false” global_module=”4766″ saved_tabs=”all”][et_pb_column type=”4_4″ _builder_version=”4.2.1″][et_pb_post_title meta=”off” featured_placement=”above” title_last_edited=”off|desktop” _builder_version=”4.8.2″ title_font=”Open Sans|700||||on|||” title_text_align=”center” title_text_color=”#000000″ title_font_size=”36px” title_line_height=”1.4em” meta_text_align=”center” meta_text_shadow_style=”preset1″][/et_pb_post_title][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.2.1″ width=”100%” custom_padding=”25px|10px||10px|false|true” animation_style=”fade” box_shadow_style=”preset1″ box_shadow_blur=”10px”][et_pb_column type=”4_4″ _builder_version=”4.2.1″][et_pb_text admin_label=”Text” _builder_version=”4.8.2″ text_font=”Open Sans|500|||||||” text_text_color=”#242424″ text_font_size=”16px” text_line_height=”1.5em” header_font=”Open Sans|700||||on|||” header_text_align=”center” header_line_height=”1.2em” header_2_font=”Open Sans|700||||on|||” header_2_text_align=”center” header_2_line_height=”1.4em” header_3_font=”Open Sans|700||||on|||” header_3_font_size=”29px” header_3_line_height=”1.3em” custom_margin=”||-3px|||”]

Money, Money, Money…

Unless you’re a member of the Kardashian family or have a wealthy uncle in your family tree, most likely, you’ll have to depend on some type of  financial aid to help you pay for the costs of attending a college or university of your choice.

financial aid to help you pay for the costs of attending a college or university of your choice.

Although the student financial aid process is complex, it’s worthwhile to apply. For many, the benefits far outweigh the aggravation of the application process.

What type of funding students receive–grants, scholarships, loans, and work-study, matters.

Colleges and universities award student aid funding based on their institutional student aid budget and the appropriations they receive from the federal government.

Students receive financial aid award notifications from their institutions and can select which type of aid they would like to accept.

Knowing the pros and cons of each – scholarship, grants, loans, and work-study – is critically important in order for you to make the best informed decision possible.

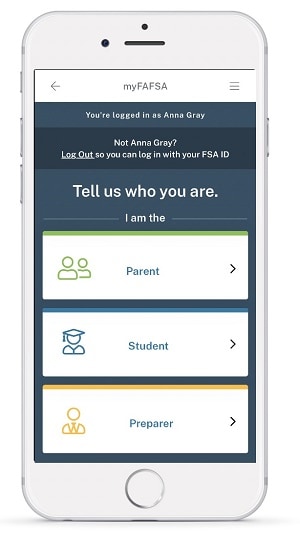

[/et_pb_text][et_pb_blurb title=”Don’t Forget to Download myStudentAid Mobile App!” _builder_version=”4.8.2″ _module_preset=”default” header_level=”h2″ header_font=”Open Sans|700||||on|||” header_text_align=”center” header_text_color=”#000000″ header_font_size=”32px”]

[/et_pb_blurb][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.8.2″ _module_preset=”default”][et_pb_column type=”4_4″ _builder_version=”4.8.2″ _module_preset=”default”][et_pb_text _builder_version=”4.8.2″ _module_preset=”default” header_font=”Open Sans|700||||on|||” header_2_font=”Open Sans|700||||on|||” custom_margin=”||-16px|||”]

As a Financial Aid Recipient…

Here are a few questions you need to ask yourself before you send your acceptance deposit to the college or university of your choice:

- In my financial aid award package notification, did I get enough grant/scholarship money to pay for just my tuition and mandatory fees only?

- As a student living on campus, did I get enough grant/scholarship money to pay for my tuition and mandatory fees, including housing and meal plan?

- This award letter is very confusing. Have I scheduled an appointment to speak with a financial aid adviser?

- If I accept the loan offered, what does that really mean to me in terms of pursuing my future educational goals?

- Must I earn the College Work-Study award money, and if so, what on and off campus part-time job opportunities are available?

- What happens if I refuse a loan and/or a work-study award?

- The loan promissory note is hard to understand. Is there a simpler document outlining my responsibilities?

- Do I have to re-apply for financial aid next year or will I just receive the same financial aid award package I got this year?

- On my college bill, do I have to pay the mandatory fees listed besides tuition?

- If I want to take classes in the summer, can I get financial aid to do so?

- What is the due date to pay my college bill and what are the consequences if I cannot pay by the deadline?

- My financial aid award is more than the actual cost of tuition and fees. Can I use the ‘extra’ money to buy books and other essentials?

- Does the college have an emergency student aid policy?

- In what ways can I lose my financial aid?

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.8.2″ _module_preset=”default”][et_pb_column type=”4_4″ _builder_version=”4.8.2″ _module_preset=”default”][et_pb_text _builder_version=”4.8.2″ _module_preset=”default” text_font=”Open Sans||||||||” text_text_color=”#000000″ header_2_font_size=”30px”]

So, What’s Next?

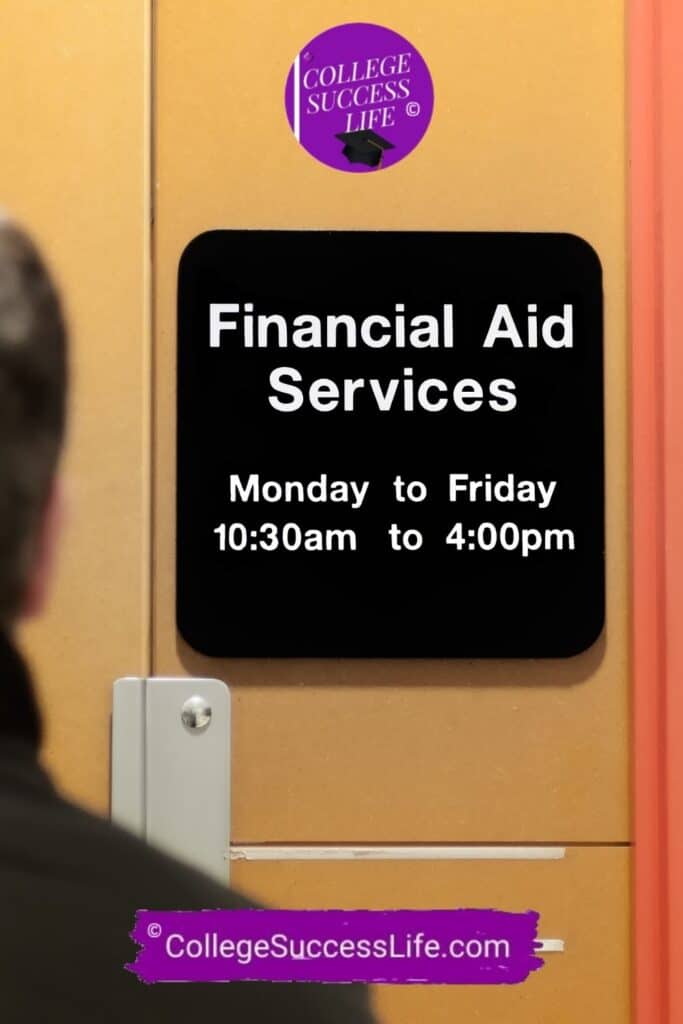

As a new student financial aid recipient, one of the best things you can do when you first arrive on campus is to make an appointment to speak with a financial aid adviser.

adviser.

What do you talk about, you may wonder?

You can review your financial aid award, request additional funding, see if there is a work-study position in the office available and so on.

Begin networking and building professional relationships on campus. And doing so with your financial aid adviser is a good place to start.

In the near future, you’re going to need recommendations and having a professional relationship with a financial aid adviser can be very beneficial.

And if you’re not quite ready to network yet, then send us an email with your concerns.

In one of my former professional lives, I was the director of student financial aid at a major public university!

#collegesuccesslife #college #collegestudent

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row _builder_version=”4.4.8″][et_pb_column type=”4_4″ _builder_version=”4.4.8″][et_pb_text _builder_version=”4.8.2″ header_2_font=”Open Sans|600||||on|||” header_2_text_align=”center”]

A Word to the Wise…

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.2.2″ custom_padding=”0px|10px|9px|10px|false|true” global_module=”4756″ saved_tabs=”all”][et_pb_row _builder_version=”4.5.6″ _module_preset=”default”][et_pb_column type=”4_4″ _builder_version=”4.5.6″ _module_preset=”default”][et_pb_text _builder_version=”4.8.2″ _module_preset=”default” header_font=”Open Sans|600||||on|||” header_text_align=”center” header_2_font=”Open Sans|700||||on|||” header_2_text_align=”center” header_2_font_size=”32px”]

An Academic Pearl of Wisdom

[/et_pb_text][/et_pb_column][/et_pb_row][et_pb_row column_structure=”3_5,2_5″ _builder_version=”4.8.2″ width=”100%” custom_padding=”||1px|||”][et_pb_column type=”3_5″ _builder_version=”4.0.1″][et_pb_text _builder_version=”4.8.2″ text_font=”Open Sans|600|||||||” text_text_color=”#000000″ text_line_height=”1.2em” custom_padding=”|10px||10px|false|false” link_option_url=”https://collegesuccesslife.com/using-your-academic-adviser-the-right-way/” link_option_url_new_window=”on” border_color_all=”rgba(0,0,0,0)”]

Whenever a college student faces an academic and/or social challenge, they often ask a peer or a friend first for advice. And that’s okay.

However, resolving the issue to your best advantage often requires consulting with an academic advising professional as well.

Your academic adviser knows the campus academically, administratively, and socially.

And what they don’t know, they can point you to the person who does know. Include this strategy in your current plan for college success.

And we’re always available to help as well!

[/et_pb_text][/et_pb_column][et_pb_column type=”2_5″ _builder_version=”4.0.1″][et_pb_image src=”https://collegesuccesslife.com/wp-content/uploads/2019/10/advice@framemily.jpg” url=”https://collegesuccesslife.com/using-your-academic-adviser-the-right-way/” url_new_window=”on” _builder_version=”4.5.6″ animation_style=”fold” border_radii=”on|4px|4px|4px|4px” box_shadow_style=”preset1″][/et_pb_image][/et_pb_column][/et_pb_row][/et_pb_section][et_pb_section fb_built=”1″ _builder_version=”4.5.6″ _module_preset=”default” custom_padding=”3px|||||” global_module=”11168″ saved_tabs=”all”][et_pb_row column_structure=”1_2,1_2″ _builder_version=”4.5.6″ _module_preset=”default”][et_pb_column type=”1_2″ _builder_version=”4.5.6″ _module_preset=”default”][et_pb_text _builder_version=”4.8.2″ _module_preset=”default” text_font=”Open Sans|600|||||||” text_text_color=”#000000″ text_font_size=”14px” text_line_height=”1.4em”]

Disclaimer Reminder: A college student’s first line of inquiry should always be with their campus academic adviser. College Success Life Coaching Advising Sessions provide additional problem-solving options to undergraduate and graduate students for further exploration on their individual campuses. Students should always consult their assigned adviser not only during the course selection process but periodically to keep apprised of programmatic changes, testing requirements, course additions/deletions, GPA modifications, etc.

Mélange Information Services, Inc. is the parent company of College Success Life.

[/et_pb_text][/et_pb_column][et_pb_column type=”1_2″ _builder_version=”4.5.6″ _module_preset=”default”][et_pb_text _builder_version=”4.8.2″ _module_preset=”default” text_font=”Open Sans|600|||||||” text_text_color=”#000000″ text_font_size=”14px” text_line_height=”1.4em”]

Affiliate Disclosure: Our primary goal at College Success Life is to get you access to the information you need to fulfill your college and career goals. Most of the information we provide is FREE. Some, like recommended books, you have to purchase. In order for us to continue to provide you with FREE College Success Life info, we include affiliate links throughout our website whereby if you purchase an item, we earn a small commission from our affiliate partner – at no cost to you. So don’t worry, we’re very selective in choosing our affiliate partners! Thanks for supporting our FREE content.

Privacy Policy and Terms of Use

For more information, please review our privacy practices.

[/et_pb_text][/et_pb_column][/et_pb_row][/et_pb_section]