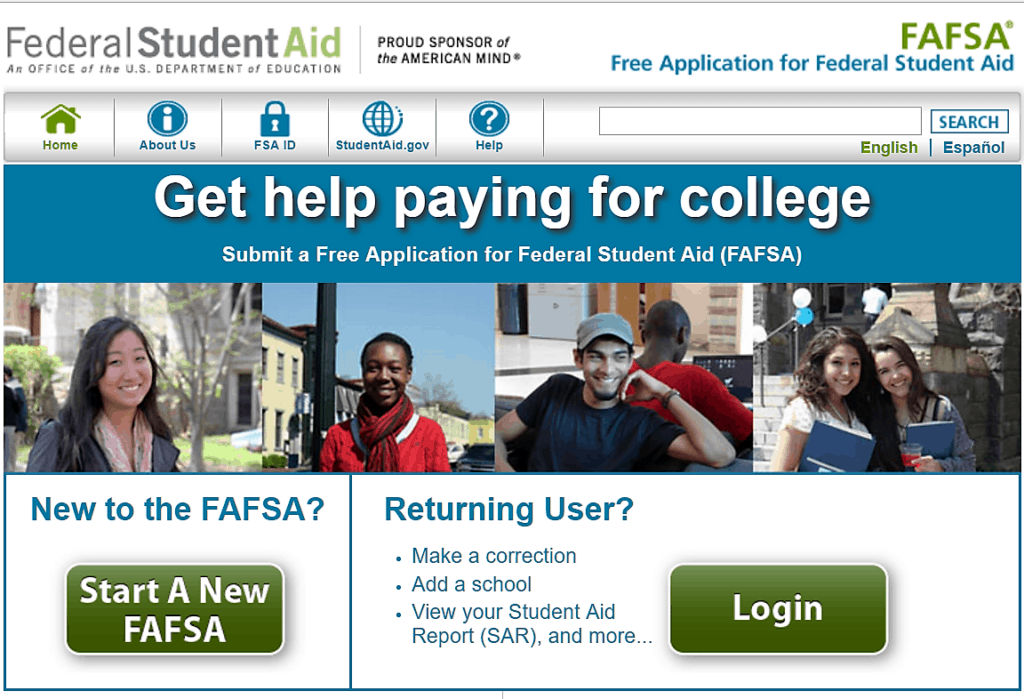

February is Student Financial Aid Awareness Month #FINAIDFEB

Who can apply for student financial aid?

Anyone can “apply”, using the Free Application for Federal Student Aid (FAFSA) … however, only U.S. citizens or eligible non-citizens can actually receive federal financial aid.

The federal financial aid process itself is very complex. Award determinations are based on a number of individual and/or family profile and income factors.

Federal financial aid awards consist of grants, loans, and college work-study. U.S. colleges and universities make financial aid awards to eligible applicants based on institutional, state, and federal criteria.

Current college student financial aid recipients must apply every year. Annual renewal is not automatic! And don’t prejudge your eligibility i.e. my parents and/or I make too much money…apply anyway. You may encounter a financial opportunity along the way.

The Free Application for Federal Student Aid (FAFSA) does provide access to a multiplicity of student financial aid opportunities!

Student Financial Aid Information Detours…

There is a lot of misinformation floating around our universe these days and info about student financial aid is definitely in the mix. Believing financial aid myths instead of finding out the real facts is a major set-up for prospective college students to miss out on educational opportunities!

Here is a typical profile of 8 student financial aid myths. How many have you heard while talking to your friends/family and filling out your college applications?

Myth #1: I think my family makes too much money for me to qualify for student financial aid, so it's a waste of time to apply.

FACT: First of all, every student living in the U.S. and planning to go to college should fill out the FAFSA form, regardless of the family household income. Approximately 85% of students attending 4 yr. colleges and universities in the U.S. receive some type of student financial aid. Family income is just one aspect taken into consideration. Other factors may include such items as college costs, the number of siblings in college, family assets etc. Most financial aid recipients receive a financial aid award package, a combination of grant, scholarship, loan, and/or work-study.

Myth #2: I support myself, so I don’t have to include my parent’s info on the FAFSA® form.

FACT: mmmmm…The Federal Government may not see it the same way you do.

If you support yourself, live on your own, or file your own taxes, you may still be considered a dependent student for FAFSA purposes. The FAFSA form asks a series of questions to determine your dependency status. If you’re independent, you don’t have to include your parents’ information on your FAFSA form. But if you’re dependent, you must provide your parents’ information.

If you’re a dependent student, determining parental status is not as obvious as you might think… Who is considered your parent for FAFSA purposes.

Myth #3: The grades I receive in college have no impact on my annual financial aid award package.

FACT: Quite the contrary! The Federal Government expects you to complete your studies within a given time frame. Therefore, they’ve have a satisfactory academic progress requirement every student must fulfill in order to continue receiving federal student financial aid. Your college or university has specific policies regarding this federal requirement. Make sure you have a thorough understanding of their expectations before the semester begins.

Myth #4: I never have to pay back any student financial aid.

FACT: If you receive a federal or private student loan, in most cases, you will have to pay back the full loan with interest. In the case of federal student loans, however, there are exceptions. FYI – over 35% of financial aid awarded is given out in the form of student loans.

Myth #5: I only have to apply for student financial aid and complete the FAFSA once, before I enter my first year of college. So I don't have to worry about filling out the FAFSA ever again!

FACT: As an enrolled college student, you must complete and submit an FAFSA every year in order to continue receiving student financial assistance. An updated FAFSA will reflect any annual changes in your family’s financial situation. This could impact the configuration of your financial aid award package for the better.

If, however, you or your family should win the lottery, then you won’t have any further need for student financial assistance.

Myth #6: There's no rush when it comes to completing and submitting the FAFSA form.

FACT: Generally speaking, the “early bird” has an excellent opportunity of receiving a better financial aid package than a late comer. So, it’s very important to pay attention to school, state, and federal financial aid application and submission deadlines.

Myth #7: There's no way my family can afford to send me to a private college or university.

FACT: Going to a private college usually costs more than attending a public college or university. Because of their costs, private colleges tend to award more financial aid in an effort to attract students from all income levels. So if you have private colleges on your college wish list, then, by all means, do your homework, complete your FAFSA, and pursue those that meet your personal and academic needs.

Myth #8: Getting a college work-study job during my first year on campus may be too disruptive in pursuing good grades.

FACT: For most new freshmen living on campus, working an on campus job 6-10 hrs a week helps significantly with time management issues. In high school, you had a regimented 6-hour schedule. In college, you basically design your own class schedule, attending classes anywhere from 3 to 5 days a week, one, two, or three classes a day. What do you do for the other 12 hours of day light…study?? Most likely not. Federal college work-study jobs are terrific opportunities to build your professional skills and work experience. Great college work-study jobs can be had on campus such as working at the library or campus athletic center. Off campus opportunities exist as well. You’ll find that most college work-study employers are sensitive to students’ academic needs and responsibilities. College Work-Study is usually included in a student’s financial aid package. Think twice before you refuse it!

If you’ve heard any of these myths, now you have the facts to make the best decisions to pursue your college and career goals! Remember to always validate your information and your information sources!! Need more information?

A Word to the Wise...

An Academic Pearl of Wisdom

Whenever a college student faces an academic and/or social challenge, they often ask a peer or a friend first for advice.

And that’s okay.

However, resolving the issue to your best advantage often requires consulting with an academic advising professional as well.

Your academic adviser knows the campus academically, administratively, and socially.

And what they don’t know, they can point you to the person who does know. Include this strategy in your current plan for college success.

And we're always available to help as well!

Disclaimer Reminder: A college student's first line of inquiry should always be with their campus academic adviser. College Success Life Advising Sessions provide additional problem-solving options to undergraduate and graduate students for further exploration on their individual campuses. Students should always consult their assigned adviser not only during the course selection process but periodically to keep apprised of programmatic changes, testing requirements, course additions/deletions, GPA modifications, etc.

Disclosure: This page contains affiliate links, which means we will make a commission at no extra cost to you, if you make a purchase after clicking my link.

![Create Your Own College Research Paper Strategy [Blueprint]](https://collegesuccesslife.com/wp-content/uploads/2019/03/FA-Problem-440x264.jpg)